|

Go-to-Market Strategy Explained with Examples

What is a Go-to-Market Strategy

Go-to-Market strategy for a startup is a part of a Pre-Term Sheet that outlines proposed investment details. Your Go-to-Market strategy has to be comprehensive and validated to impress the investor and secure the budget for market expansion.

A good GTM strategy includes a detailed description of your product and the market. It’s crucial to choose the right timing and make a five-year financial forecast for the company’s introduction to the new market.

GTM Strategy AI-copilot

76% of entrepreneurs are not prepared for interacting with investors. Try our AI-copilot to learn if your planned investments are enough to acquire the target number of customers. Get a competitive edge with a valid primary Go-to-Market strategy.

Glossary

Marketing Mix Modeling (MMM) is a statistical analysis technique that uses historical data to evaluate the contribution of various factors on target business results.

Metamodeling is a type of MMM approach that is based on market benchmarks and other models so it can be applied when there is no historical data available.

Market share is a revenue percentage that a business makes compared to its competitors and industry on the whole.

Customer acquisition cost (CAC) — is how much a business spends to acquire a new customer.

Who is responsible for a Go-to-Market Strategy

Product Marketing Manager is the one in charge of building a Go-to-Market strategy. And a successful GTM strategy starts with healthy and clear communication between PMM and key stakeholders. It helps to improve decision-making process on key strategy points as any arising uncertainties are quickly clarified.

Another crucial player in the process is the Product Manager, and establishing a dialog with them is essential. According to the Product Marketing Alliance report, the main challenge for 62% or marketers during the Go-to-Market process is the lack of communication with product teams.

If you have never made a five-year GTM strategy, you need to consult an expert to learn about pitfalls and avoid mistakes.

Tip: Never try to build a Go-to-Market strategy on your own.

What is a good Go-to-Market Strategy

Simply put: A Go-to-Market strategy is a comprehensive long-term plan on generating revenue and scaling with calculation of required resources.

Go-to-Market strategy should be the result of professional expertise while remaining simple to understand. Table format is an optimal choice that makes your GTM strategy flexible and allows investors to change assumptions.

While the specifics of a go-to-market strategy may differ across industries and business models (B2B, B2C, D2C), certain key elements remain consistent. When evaluating a Go-to-Market strategy, investors prioritize insights backed by research and calculations concerning the following fundamental factors.

According to Morgan Stanley, customers, revenue growth and costs are the most important metrics when it comes to enterprise valuation. That is why it’s necessary to accurately forecast and monitor sales and marketing metrics.

Investors scrutinize every detail of a Go-to-Market strategy to make sure the deal is worth their efforts and money and minimize risks. And the amount of questions they pose is not surprising if you learn that the failure rate for all startups is 90%.

Only 10% of startups meet their Go-to-Market strategy targets.

Build a valid Go-to-Market strategy with realistic marketing goals.

Market research for a Go-to-Market strategy

Every GTM strategy should start with deep market research. It will help the company to evaluate its potential, minimize risks, optimize the product so that it meets customers’ needs.

You should find something that lacks on the market and fill that niche. Demand for a certain product obviously increases chances for success, while around a third of startups fail because there is no market need for what they sell. But even if there are already numerous competitors, it’s still possible to come up with solutions that will be in demand.

Successful market launch cases:

- InDrive created a taxi service with the possibility for the driver and passenger to negotiate the price, which makes it attractive for users and differentiates from competitors.

- Fenty Beauty realized that the makeup market lacked a brand that’s inclusive enough and created product lines with a very wide range of shades to match different skin tones.

Tip: Examine recent IPOs (10Ks, annual reports) within the same industry or sector. Analyze recent investments made in similar companies. Utilize third-party resources, including government databases, reports, publications, and market experts to identify comparable financial models and benchmarks.

Market research will help you successfully do the following:

Select the right initial market: It should be big enough to convince investors that there is enough potential (typically, it has to be worth at least a $1 billion). It’s possible to start with a small initial market if your company can expand into other markets, but you need to present your growth strategy. Pointing out not only current opportunities but also future ones in your GTM strategy also enhances the appeal of your investor pitch, showcasing long-term potential, which can significantly bolster investor confidence in committing funds to your startup.

Measure the potential market size: Conduct extensive research to support financial assumptions, revenue models, and valuation. Start by validating the presence of the problem your offer addresses. Identify the geographical and demographic contexts where this issue is prevalent. Analyze search queries and media references to understand how frequently the problem is mentioned.

- Outline your total available market (TAM), which is the total market value in monetary terms. You can do this by studying open research, competitors’ reports and press-releases. By studying forecasts from experts and comparing recent reports with reports from 5-10 years ago you can learn more about the potential, trends, and see if the TAM is growing. It happens if the number of customers is increasing and new niches appear.

- Serviceable available market (SAM) is the next thing you need to measure for the Go-to-Market strategy. It will include potential customers that are already using products similar to yours. Analyze the segment by studying all the competitors and similar solutions. Study their revenue, traffic and spends. Analyzing your primary competitors will also help you understand whether you have evaluated your strengths and weaknesses realistically. Another reason to study competitors is to check for insurmountable obstacles to enter SAM, like monopolistic companies or increased competition.

- Serviceable obtainable market (SOM) is a part of SAM that you can actually capture initially and it heavily depends on your resources. Identifying your SOM based on the company’s current capabilities is crucial for making accurate financial projections and focusing on appropriate market development. To make sure you’re not setting too ambitious goals in your Go-to-Market strategy, calculate how many new customers you can acquire with your planned budget.

Develop an appropriate market share strategy: To win against the competitors you need to examine their offer and improve it. Standing out in a sea of similar products requires a formidable marketing and sales strategy. This encompasses the creation of engaging creatives, relevant messaging, and selecting the most effective communication channels. The composition of the media mix varies depending on industry segment, product type, and growth stage.

Employing benchmarks and Marketing mix modeling allows you to pinpoint the optimal combination that suits your case. With advanced MMM solutions you can measure and forecast campaign ROI, evaluate channel saturation to avoid overspending, take into account adstock effect and lagged effect of advertising to make data-backed decisions about your marketing mix and maximize sales or other target business results.

With a well-prepared Go-to-Market strategy, you are 68% more likely to secure startup funding.

Develop a valid Go-to-Market Strategy for your business, including calculations of CAC, obtainable market share, required campaign budget, and risk evaluation.

Customer research

Investors need to understand who will be your customer and want this information to be included in the Go-to-Market Strategy.

Customer Persona is a representation of your ideal customer. Create detailed customer personas based on demographics, interests, and behaviors to visualize your customer segments. It will help you to optimize the product itself as well as craft relevant messaging and creatives for promotion.

Use services for analyzing user behavior on the website and profiles on social networks. From social networks you can study what interests and hobbies your potential customers have, what challenges they face.

Analyze customer base and customer segments: This recommendation is for the cases where the company has already made sales. Data about the customer base will help you to learn more about the number of new, loyal and at-risk customers, sales cycle, distribution channels, and seasonality.

- Use RFM analysis (Recency, frequency, monetary value) to identify your most valuable customers based on their purchase behavior. There are 20% of customers that generate 80% of the revenue, and key product features that contribute the most to customer loyalty. This information will show you what to focus your efforts on.

- You can also carry out Cohort analysis that involves studying groups of users who share a common characteristic or experience within a specific time frame to identify the stick point for your product.

Revenue growth forecast

Customer data, whether they are potential or existing, allows you to make budget calculations and forecast revenue growth. If your product is already on the market, you need to keep records of your sales and promotional activities to make such calculations. In case when you don’t have any historical data yet, you can rely on benchmarks and the metamodeling approach for this purpose. It allows you to minimize risks and optimize your Go-to-Market strategy using experience of other players in your industry.

In the assessment of a Go-to-Market Strategy, investors direct their attention toward company valuation, break-even point calculation, and the credibility of revenue forecasts.

Current company valuation: Demonstrate that it’s aligned with the company’s developmental stage and market potential. You can use the formula below to calculate the enterprise value.

Calculate the break-even point to understand when your company will achieve cash flow positivity. It will also help you better plan the budget necessary for that period of time. It’s very important to include accurate and comprehensive calculations into your investor pitch to make your Go-to-Market strategy convincing and reliable.

Remember to take account of growth in your projections and demonstrate that they are realistic with calculations and research results. Investors want to see robust assumptions about your company’s growth rate, acceptance rate, pricing and revenue streams.

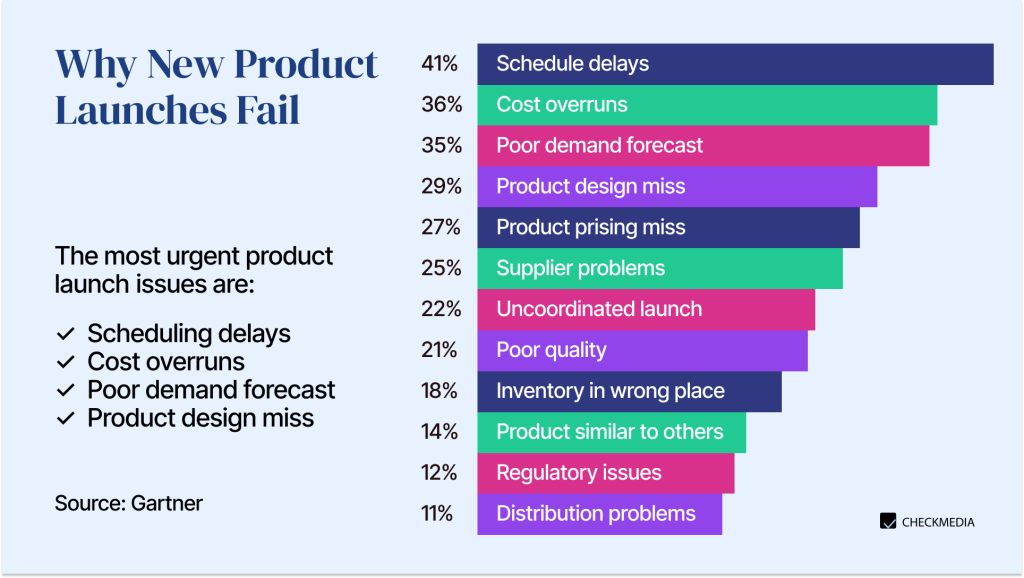

Make realistic revenue projections by considering your operational capabilities and resources necessary for promotion, maintaining the product and providing customer service. Since revenue depends on your future customer base, you can analyze your campaign budget to see if it is enough to get the target number of customers. Below is a graph illustrating the average growth rate of companies across various industries during their first three years. While this information can be included in your Go-to-Market strategy, investors also expect to see your company’s revenue projections.

You can get a free AI-based calculation by answering a few questions about your product. Learn whether your current Go-to-Market campaign is likely to succeed or you are going to land in a yellow or red risk zone unless you make some changes to your budget plans.

87% of investors reject startups with high-risk Go-to-Market strategies.

Learn what risk zone your calculations fall into with our AI-copilot.

Develop a comprehensive sales and marketing strategy: As we’ve mentioned earlier, this element of a Go-to-Market strategy is crucial for successfully reaching and attracting your audience. But a right promotional strategy balances growth and profitability thus increasing the company valuation and market cap. Investors have shifted their attention from companies showing an outstanding growth rate to those that can also provide and explain their path to profitability.

Choose a suitable partnership model (if necessary): in many cases it’s much easier to launch through a partnership as it gives access to a wider audience and other resources like distribution channels, funding, technology, expertise and networking opportunities. Associating with a large well-known partner will increase a startup’s credibility or serve as a form of market validation.

A well-structured partnership can enhance your Go-to-Market strategy and instill investor confidence, showcasing strategic alliances that contribute to the overall success and sustainability of your business. You can choose one of the following partnership formats.

Expected costs

Your Go-to-Market strategy has to include the required investment amount. CAC will be the main cost followed by operational expenses.

With data on your existing customer base and/or SOM you can calculate this important metric and its dynamic. Since CAC is not constant and changes as your market share grows it’s important to have a reliable forecast for this metric to adequately budget future marketing campaigns.

To make sure your Go-to-Market strategy includes adequately planned future financial needs, take into account operational costs and growth projections to be able to deliver the results you are planning.

82% of investors are willing to provide the budget necessary for achieving Go-to-Market Strategy objectives.

Calculate the required budget for your business to meet Go-to-Market Strategy targets. You will calculate CAC and learn how much you need to spend to get the target number of customers. You will also receive a budget risk evaluation to determine if it’s sufficient to reach the desired customer acquisition goal.

Go-to-Market strategy example

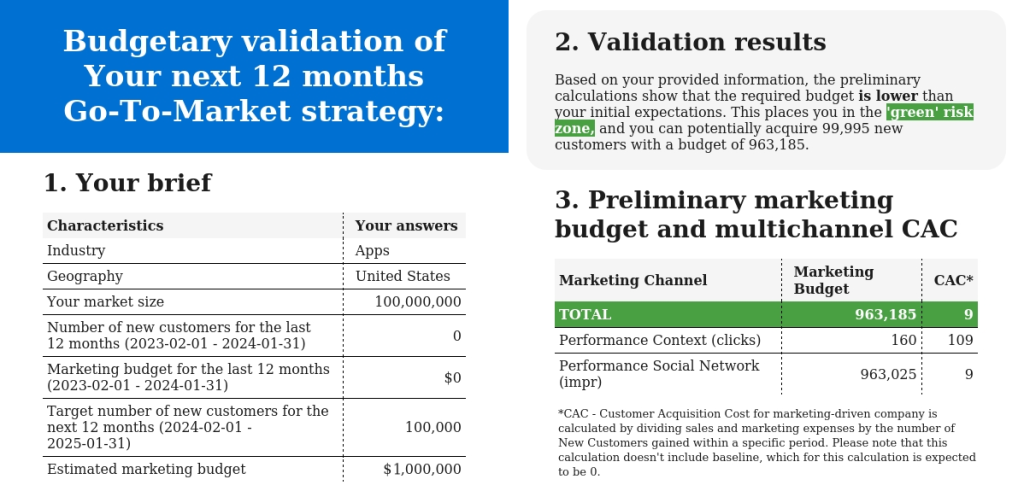

In our example we are going to build a Go-to-Market strategy for a startup that is planning to launch an app in the United States. Let’s check how profitable the startup is going to be.

TAM: By analyzing demographic data we came to the conclusion that the number of potential users is around 100 mln. Market research by Statista shows that the US App market is expected to generate $172 bln. in 2024. And with an annual growth rate of 10% the market volume is projected to reach $230 bln.

SOM The first product version is ready and the startup wants to raise money for marketing to test channel efficiency and acquire customers. Let’s use MMM and a metamodeling approach to calculate the budget for the promotional campaign and get marketing mix recommendations.

Marketing budget for the first 12 months is $ 1 mln., and the campaign target is to acquire 100,000 new users. The calculation result shows that with the planned budget the startup lands in the ‘green’ risk zone and this money is enough to meet the target. The recommended channels for an initial ad campaign are performance context and social media.

This is a preliminary budget calculation for a primary Go-to-Market strategy. To get a more accurate result you need to use an advanced GTM Strategy solution.

Create a primary Go-to-Market strategy with a validated budget and optimal marketing mix for your industry.

Conclusion

The best Go-to-Market strategy is the one that is based on market and customer research, supported with 5-year revenue and cost forecasts. It should be comprehensive yet simple to interpret and explain if you want to prepare a compelling and impressive investor pitch, crucial for securing financial support. Relying on experts to approach this task will increase your chances of success and reduce risks. CheckMedia offers the expertise, tools and insights needed to craft a data-driven Go-to-Market campaign.