|

How we Reduced CAC and Implemented FP&A for a Lottery Operator

In this case study, we outline how we helped a client to implement transparent and accurate financial planning for four brands. We demonstrate how AI-based ROI analytics was applied to reduce CAC by 16% and guide future marketing optimization.

Below is the step-by-step process we followed to address the client’s challenge.

Table of Contents

- Client & Challenge: Who is the client, and what challenges are they facing? What are their expectations from working with us?

- Three phases of success: Three ways to use CheckMedia’s tools and services, and the results achieved at each stage.

- Conclusion

Client & Challenge

The client is a lottery operator competing in a market dominated by well-established players. Their strategic ambition is to optimize CAC.

The key challenge they faced was finding a way to drive customer acquisition without increasing their current marketing spend.

The client engaged CheckMedia with three core objectives:

- Reduce CAC below $50

- Identify a marketing investment path to achieve growth

- Implement regular financial planning and performance analysis for marketing

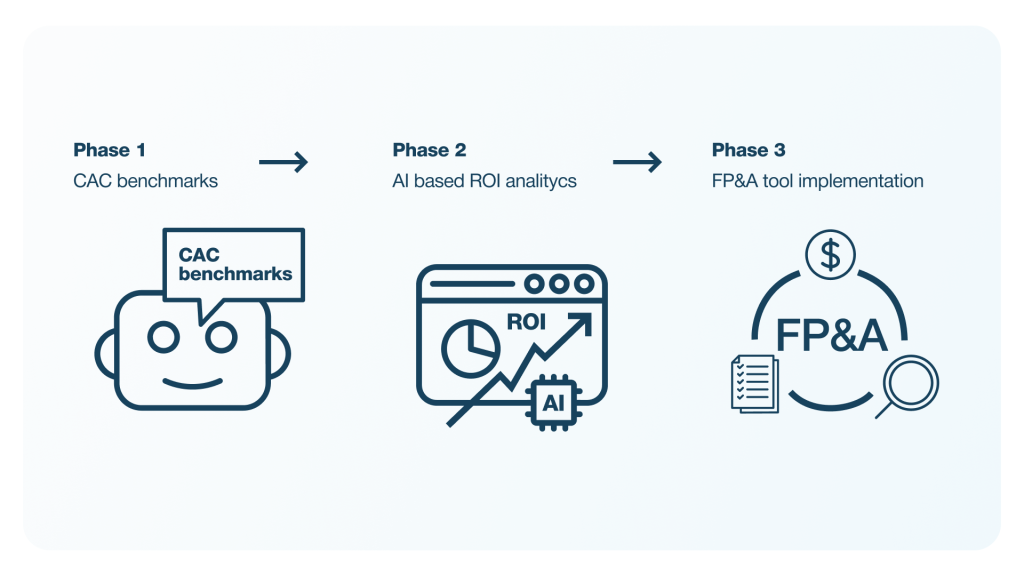

Three phases of success

The client’s journey with us progressed through three phases, with a specific analytical tool implemented at each stage, moving from basic to more advanced solutions.

1. CAC benchmarks

First of all, the company used our AI-powered chatbot to find out if their objective is realistic. Before working with us, they were only able to measure CAC for performance channels and couldn’t evaluate the effectiveness of offline channels. Although this phase is free of charge, it provides valuable insights. Within 5 minutes the client received a personalized report, which showed the CAC could be reduced by $15 for performance campaigns and by $2.20 across the overall media mix.

After the client learned their CAC can be reduced, they reached out to identify practical recommendations for optimization with more granular analytics.

2. AI-based ROI analytics

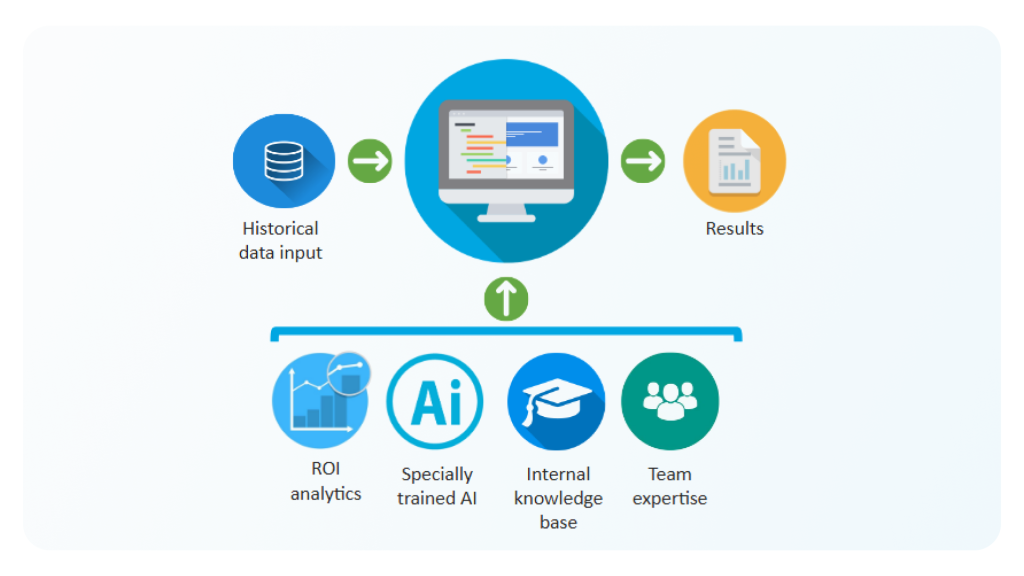

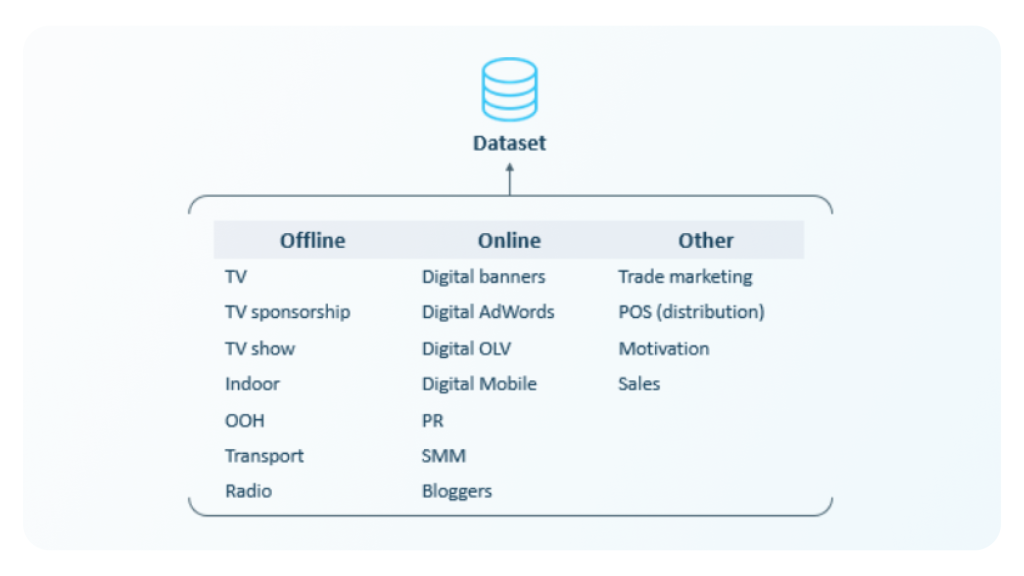

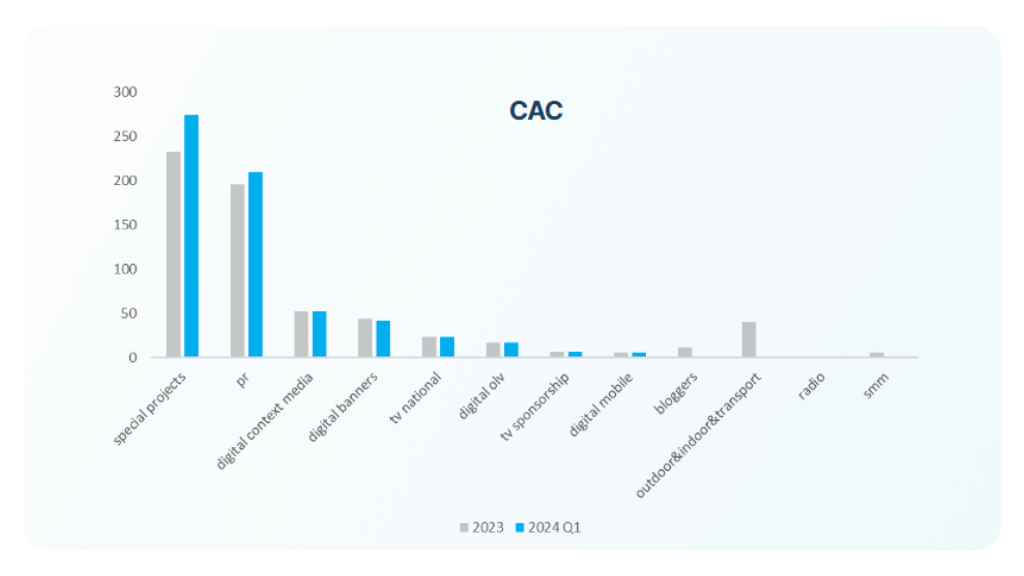

Firstly, we collaborated closely with the client to ensure the dataset collected was as comprehensive as possible, as data quality directly impacts result accuracy. The company leverages a diverse mix of channels – online and offline, media and non-media, covering both performance and brand advertising.

However, many analytical tools are unable to measure the offline channel performance, so the company lacked a full understanding of each channel’s contribution to new customer acquisition. That’s why before working with CheckMedia their perception of effectiveness was limited and somewhat skewed by reliance on post-view and post-click analytics.

Based on historical marketing data we built an MMM model to measure the effectiveness of each channel in the company’s media mix. Decomposition analysis showed the contribution of each marketing activity to the number of new players.

Our CAC and ROI calculations revealed that a significant portion of the client’s budget was allocated to high-cost, underperforming special projects and PR, while more efficient digital channels were underfunded. This raised the critical question: was there potential for increased investment in digital channels? To answer this, we turned to response curve analysis.

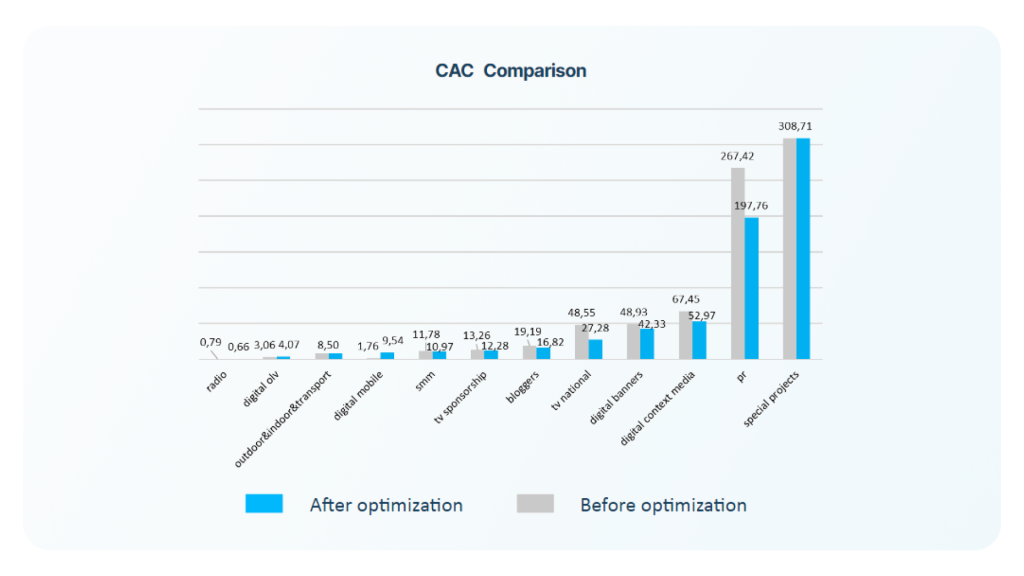

Our response curve analysis identified substantial opportunities for media mix optimization. We also determined optimal investment ranges for each channel using channel-specific return curves and saturation limits.

CAC Optimization results

Based on our understanding of CAC and the potential capacity of each channel, we can build an optimal media mix. This allows us to invest marketing budgets more efficiently and identify the scenario that delivers the maximum KPI within a fixed budget.

The client’s objective was to maximize the number of new players within a fixed budget of $12.4 million for 2024 and $20.4 million for 2025. Based on this scenario, the model recommended reallocating the existing budget without increasing it, resulting in the following outcomes:

Q4 2024

- KPI (new customers): 1.826 million, an increase of 6.4%

- CAC: $6.77, a decrease of 6%

2025

- KPI (new customers): 2.963 million, an increase of 19%

- CAC: $6.90, a decrease of 16%

And the graph below shows the per channel CAC reduction.

3. FP&A tool implementation

To maintain the results achieved and improve portfolio management, the client decided to implement an FP&A tool. In this case, it was delivered as an on-premise solution.

We implemented the FP&A tool with Plan-Actual analysis for four products, achieving a forecast accuracy of 97.5%. Extensive data assembly processes were automated to support ROI models for four brands, enabling 48 plan-vs-actual analyses (4 brands x 12 months). The cost of running these analyses was also reduced thanks to FP&A implementation.

This tool supports quarterly tactical optimizations for all four brands, ensuring transparent and accurate financial planning.

Conclusion

This case study is a prime example of how AI-based ROI analytics can unlock untapped growth potential, even in highly competitive markets. By challenging assumptions, rethinking media allocations, and simulating future scenarios, we helped the client reduce CAC by 16% — all within the existing marketing budget. The marketing mix model we built doesn’t just optimize for today; it provides a dynamic decision-making framework that the client can rely on to continuously adapt, innovate, and stay ahead of the competition.